How Do I know if I Qualify?

Are you thinking of making a move to the Mid-Willamette Valley? If you are an Oregon first-time home buyer, this guide will help you attain your goals of homeownership. Purchasing a home can be an uphill battle. The median home price in the Benton County area for a 3 bedroom is $472,500, Linn County is $384,250 and Lane County is $437,500 – well above the national average of $348,000 and up more than 5% 7% and 8.3% respectively, year-over-year. The Oregon housing market has been tight and left buyers with limited options, stiff competition, and skyrocketing prices. For more information on the condition of the market in these areas, you can view our Things to Consider this Spring 2023.

Fortunately, you can qualify for many first time home buyer programs in Oregon if you are within 80% of the median income for the state. These programs can put homeownership within reach for many. This guide covers everything you want to know to get down payment assistance in Oregon and first time home buyer grants.

Oregon First Time Home Buyer Savings Account

The First-Time Home Buyer Savings Account Oregon law lets Oregon residents reduce their tax liability while saving up for their first home. Everyone qualifies for this benefit. It allows you to deduct up to $5,000 ($10,000 for married couples) from your Oregon taxable income for deposits you make into a First-Time Home Buyer Savings Account per year for up to 10 years.

To qualify, you must be an Oregon resident who has not owned or purchased a single-family home in the last three years. You must use your FTHBSA funds to pay costs associated with buying a home, such as:

- Down payment

- Title insurance and other closing costs

- Realtor commissions

- Appraisal and inspection fees

- Loan origination fees

Note that the account must be opened by December 31, 2026, if they don’t extend the date. The funds must be used to buy a home within 10 years of opening your account. There is a penalty for not using the funds for home ownership (5 % penalty fee, and deferred taxes accrue as income on that years return.

Many banks and credit unions offer an Oregon first time home buyer savings account. Here are two options with links to open an account. There are other banks that provide this, but they tack on more penalties.

Two Percent Down Payment Grant

IDA participants earn matched savings toward the purchase of major assets, such as their first home, post-secondary education, a vehicle, or assistive technology for work. You can choose to use two types of IDAs in your lifetime. A house seems like a good choice, but the others could be helpful, too!

An IDA works by providing a 5-to-1 match for your savings up to certain limits.

DevNW receives state funds to make the IDA program possible. The match money is a grant to you; it is not a loan and does not need to be paid back.

General Eligibility Requirements

You must meet the following general eligibility requirements to participate in the program:

- Be an Oregon Resident.

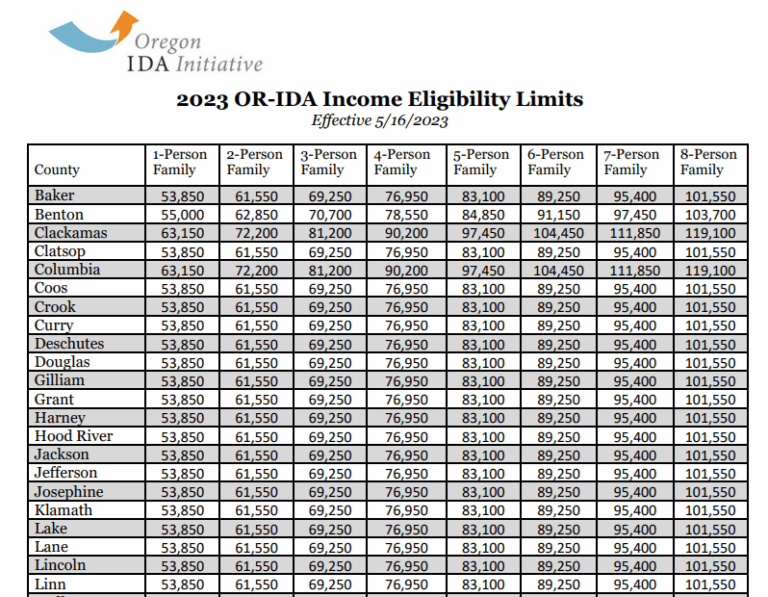

- Have a household adjusted gross income, according to household size, at or below 80 percent of the median for your county. Please see the attached table for qualifications. Your adjusted gross income can be found on your filed tax forms. They typically look at the year prior for qualifications.

- Have a household net worth at or below $20,000.

How Does the Program Work?

As an IDA participant, you would have several responsibilities:

- Complete a total of 16 hours of education — eight hours of financial education and eight hours of education specific to the asset you are saving for. You must sign up for and complete the financial education course prior to enrollment.

- Work with an Asset Building Specialist to create a budget based on 30 days of tracked expenses, reflecting your ability to save on a monthly basis to reach your savings goal.

- Establish a savings goal and timeline for completion including making regular monthly deposits toward your goal in a joint/custodial account.

- If you would like more information on the IDA program, contact the DevNW office. HERE

IDAs are funding-dependent (most times they have a waiting list), on a participant-eligible, first-come-first-served basis. Funding for 2023 starts in July (the beginning of the financial year). There is work to do before this, so sign up for some classes ASAP and get qualified. As long as I have been watching this program, it runs out of funds by the end of the fiscal year (that’s December).

Oregon Individual Directed Account (IDA)

IDA participants earn matched savings toward the purchase of major assets, such as their first home, post-secondary education, a vehicle, or assistive technology for work. You can choose to use two types of IDAs in your lifetime. A house seems like a good choice, but the others could be helpful, too!

An IDA works by providing a 5-to-1 match for your savings up to certain limits.

DevNW receives state funds to make the IDA program possible. The match money is a grant to you; it is not a loan and does not need to be paid back.

General Eligibility Requirements

You must meet the following general eligibility requirements to participate in the program:

- Be an Oregon Resident.

- Have a household adjusted gross income, according to household size, at or below 80 percent of the median for your county. Please see the attached table for qualifications. Your adjusted gross income can be found on your filed tax forms. They typically look at the year prior for qualifications.

- Have a household net worth at or below $20,000.

How Does the Program Work?

As an IDA participant, you would have several responsibilities:

- Complete a total of 16 hours of education — eight hours of financial education and eight hours of education specific to the asset you are saving for. You must sign up for and complete the financial education course prior to enrollment.

- Work with an Asset Building Specialist to create a budget based on 30 days of tracked expenses, reflecting your ability to save on a monthly basis to reach your savings goal.

- Establish a savings goal and timeline for completion including making regular monthly deposits toward your goal in a joint/custodial account.

- If you would like more information on the IDA program, contact the DevNW office. HERE

IDAs are funding-dependent (most times they have a waiting list), on a participant-eligible, first-come-first-served basis. Funding for 2023 starts in July (the beginning of the financial year). There is work to do before this, so sign up for some classes ASAP and get qualified. As long as I have been watching this program, it runs out of funds by the end of the fiscal year (that’s December).

HomeStart Down Payment Assistance

FHLB Des Moines

Federal Home Loan Bank of Des Moines offers a HomeStart program that lets eligible buyers receive up to $7,500 in closing cost and down payment assistance in Oregon. The first time home buyer assistance is offered by FHLB Des Moines through member financial institutions.

To qualify for the Oregon down payment assistance, your household income cannot exceed 80% of the area median income for the location where you are buying a home. Please see the table above for reference. You must complete a home buyer education course and qualify for a home loan with a participating lender. You will need a signed Purchase and Sale Agreement to enroll in the program.

As one of the best Oregon first time home buyer grants, the funds can be used toward your closing costs or down payment. It can also be used for repairs related to the purchase.

Note that you are required to repay a prorated portion of the grant if you sell your home within 5 years.

Funds for the HomeStart program tend to run out quickly. For 2023, the HomeStart funding schedule is $1.5 million on January 3, April 3, July 3, and October 3. If you are interested in the program, try to get qualified and approved as soon as possible after a funding date.

DevNW

Serving Linn, Lane, and Benton counties, DevNW is a nonprofit founded in 2019 to revitalize neighborhoods, support small businesses, and help residents buy homes. They provide viable paths to homeownership and home maintenance with affordable homes for sale and rent and first time home buyer assistance.

They are one of the providers for the Oregon Individual Development Accounts (IDAs). Currently providing a 5:1 match on your savings for one, two, or three years. The program requires an annual DevNW membership which is $75 for a household. To qualify, you must have household net worth under $20,000 and household adjusted gross income at or below 80% of the county median, please see the table above for 2022, and check their website for the updated table of other years. See details on their site. HERE

DevNW also offers down payment assistance for a first-time home buyer in Oregon. Receive up to $15,000 through the Oregon first time home buyer program if you are at or below 100% of the area median income, meet for homeownership consultation, and complete the DevNW Homebuying Foundations class. This available in the counties they serve. For more information about this program, click HERE.

Want Assistance Navigating the Programs?

Never purchased a home before? The Home Buying steps and general qualifications can be found on our post called Buying a Home – First Steps. There are some mortgage options available for first time home buyers that are partially subsidized by the state. I have great resources for those programs. I also have worked with IDA recipients, and volunteered to be a financial coach with Catholic Charities. Please give me a call or text anytime!